OUTLOOK 24 - Media Market Forecasts

ADVERTISING INVESTMENT

The Irish advertising industry withstood another volatile year in 2023. Against a backdrop of high interest rates, excessive inflation, military conflict in the Middle East and Ukraine, and the continued fragmentation of media consumption, the industry proved robust once again as advertisers continued to invest in the sector.

2024 is expected to be another turbulent year with Ireland now officially in a technical recession. There is good news though, with the annual rate of inflation easing last year. According to the CSO, with the annual rate of inflation to December 2023 fell to 4.6%.

While the lower inflation levels are welcome, any positive impact on household budgets are likely to be offset by continued high interest rates in 2024, with experts believing any reductions will be small and not implemented before the summer of this year. This delay could impact consumer spending.

TOTAL MEDIA MARKET

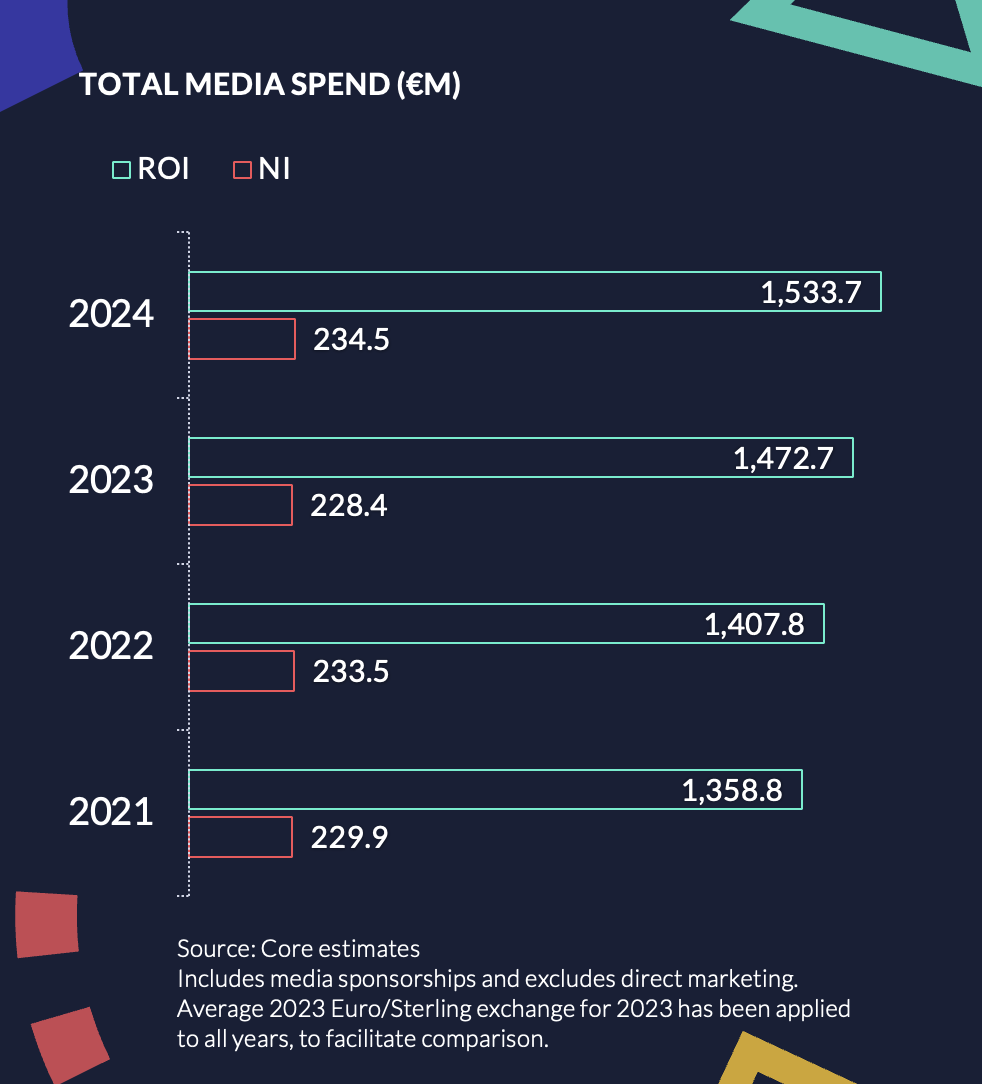

The overall market in the Republic of Ireland grew by 4.6% in 2023 to €1,472.7 million. Print once again declined in line with shrinking circulations and lower brand count, while TV also declined as consumption of video continued to fragment.

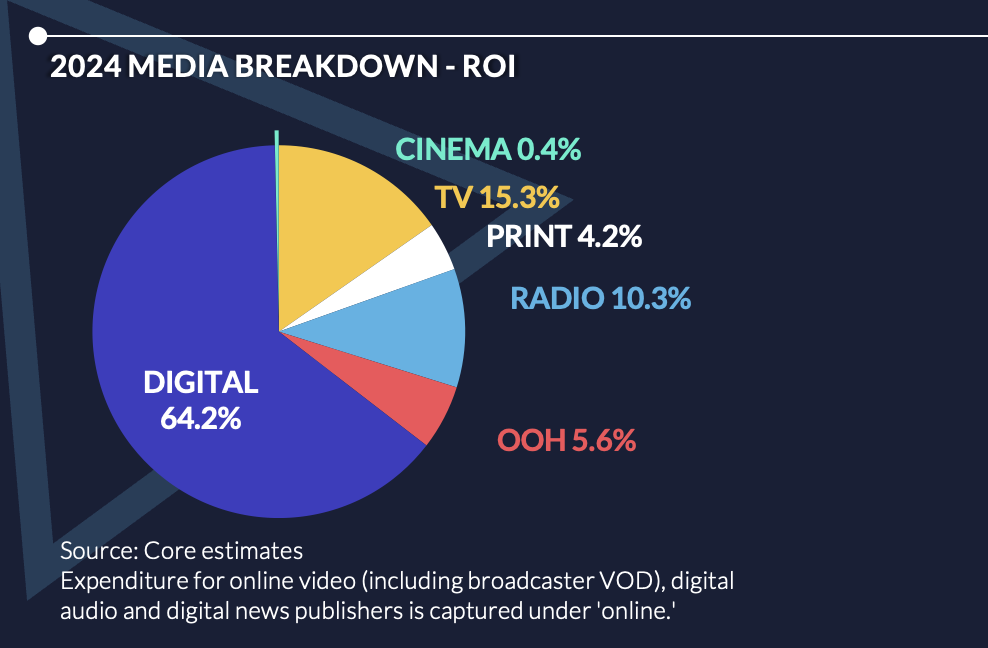

All other media witnessed growth with Out-Of-Home and Digital growing by the largest percentages. Out-Of-Home continued to bounce back post-Covid while Digital had another year of growth on the back of a strong year for online video and social media.

For 2024, we’re predicting further growth in the market for the Republic of Ireland of 4.1% to €1,533.7 million. Trends are very similar to what we witnessed in 2023 with Out-Of-Home and Digital expected to be the key drivers of growth.

Total media spend across offline media is expected to contract by 1.9% to €549.1 million in 2024, while digital channels will increase by 7.9%.

The key watch-outs will be the impact of major sporting events on consumption habits in the year ahead. Euro 2024, without the Irish team, will take place in June from Germany, followed by the Olympic Games which will be held in Paris across July and August. As ever, advertising revenues are expected to increase during these periods.

In Northern Ireland, overall media expenditure fell by approximately 2.2% to £198.9 million (€228.4m) in 2023. The contraction in media expenditure was driven by a significant decline in government spends across the year, a category that the market is heavily reliant on. The considered view is that the government spends will be better in 2024 and we are currently forecasting 2.7% growth next year to £204.3 million (€234.5m). However as outlined in previous reports, the political climate will have an influence on the performance in 2024.