Consumer Mindset - September 2023

This report is informed by the Credit Union Consumer Sentiment Index,

in partnership with Core Research.

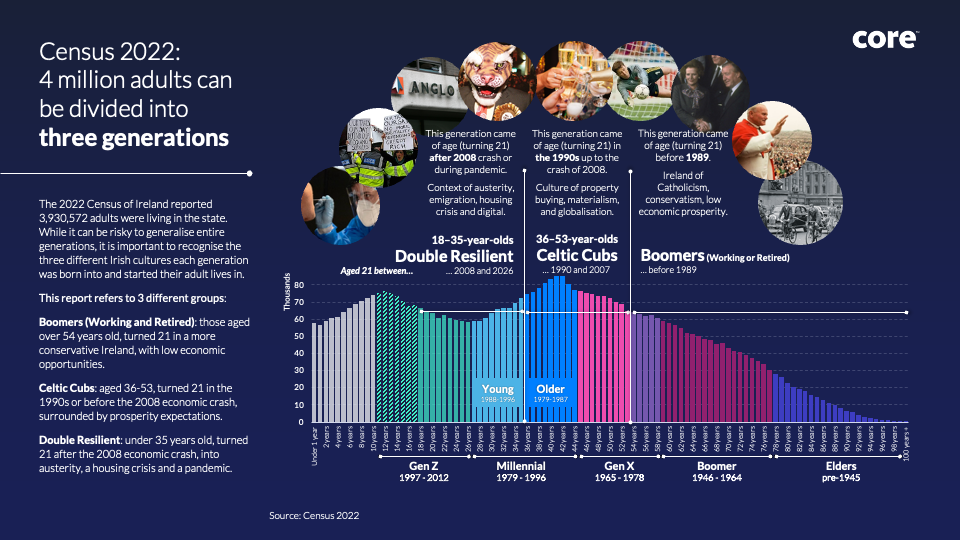

To provide further understanding of what is influencing the consumer confidence and the mood of the nation, this month’s report introduces Generations as a new way to analyse our data.

Dividing the country into three generations, provides us with a greater understanding of the needs and expectations of these three generations. People are influenced by the type of Ireland they were born in to, when they turned 21, and the economic, social and political forces which shaped their expectations. As we approach a Government Budget announcement in October and plan for 2024, this should provide some insight into the differences between young, old and everyone in between.

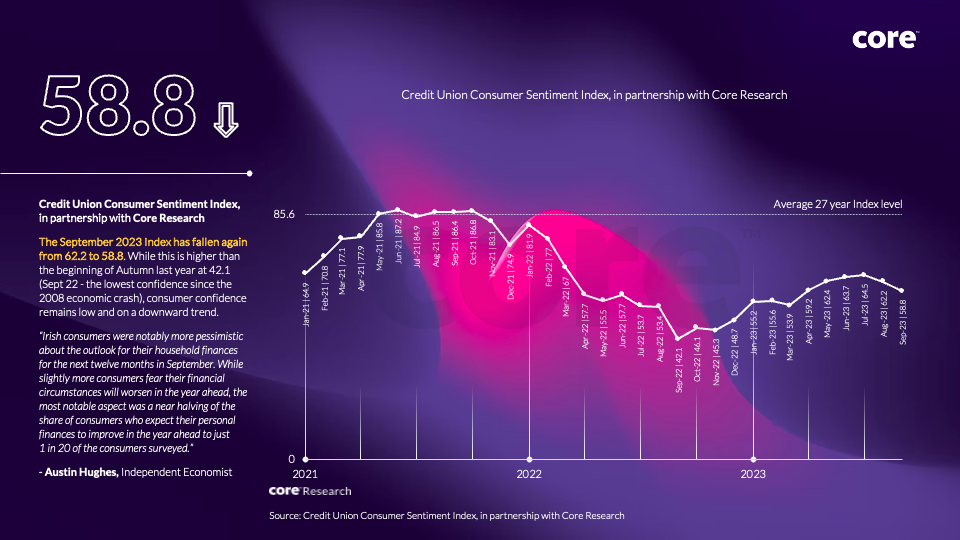

CONSUMER CONFIDENCE FALLS AGAIN

The Credit Union Consumer Confidence Index, in partnership with Core Research has slipped again to 58.8. This remains well below the twenty-year average, but higher than this time last year, when we saw the lowest level of confidence since the 2008 crash.

So, what is driving this stubbornly low level of consumer confidence in a country which economic stats would suggest is doing very well indeed? As the report will outline, there continues to be a low level of optimism that Ireland can over-come or meaningfully tackle inflation. The public don’t believe stakeholders, such as companies or the Government, are supporting their efforts in minimising the impact of inflation. While energy companies announce price cuts, and banks state they have yet to pass on ECB rates in local mortgage rates, people don’t feel this is any way helping their financial woes.

HAPPINESS PREVAILS (FOR SOME)

Despite the low level of consumer confidence, happiness remains relatively strong within the population. 43% of people say they are happy, compared to 39% of people who say they are stressed.

Working Boomers (those aged over 54) are most likely to say they are happy, while those aged 18-35 (Double Resilients) are most likely to say they are stressed. The older generation are closer to retiring, outright homeownership and have raised a family, while the younger group are juggling work-life with home-life and more likely to be trying to find a place they can afford.

FUTURE PRIORITIES: INTER-GENERATIONAL CONSENSUS ON HOUSING

In the September report, there is also analysis of the public expectations for Budget 24. The four areas which people believe should be prioritised are improving the health system, providing support on energy costs, providing supports for general

cost-of-living, and addressing the shortfall in housing.

There is full consensus on investment in the health system across all generations, while the mid-generation (Celtic Cubs), aged 36-53 years old, are more likely to demand cost-of-living supports, compared to the agreement between younger adults, and their parent’s generation that the Budget should focus on housing.

Short-term handouts might win a group in the middle, but long-term investment is valued by two-thirds of the population.